The stock market is starting 2025 with a mixed bag: Wall Street is up while China is down. This is a natural reaction after Wall Street retreated in the last few days of 2024. We expect a confusing start to 2025, with the rest of the year likely being more difficult than 2024.

China's decline is driven by concerns about its reliance on monetary stimulus, which we believe is insufficient to boost the economy without structural reforms and fiscal support. The incoming American administration's trade restrictions on January 20th will also negatively impact China's export sector. Additionally, China's centralized economy struggles to shift its focus to private consumption due to limitations on resource allocation and price setting.

The recent poor Manufacturing PMI (Caixin) reading (50.5 vs 51.5 previous vs 51.7 expected) further reinforces these concerns.

Meanwhile, the US market is likely to remain positive, despite an ISIS attack and a Tesla Cybertruck explosion in Las Vegas. The market has already adjusted to the possibility of occasional attacks.

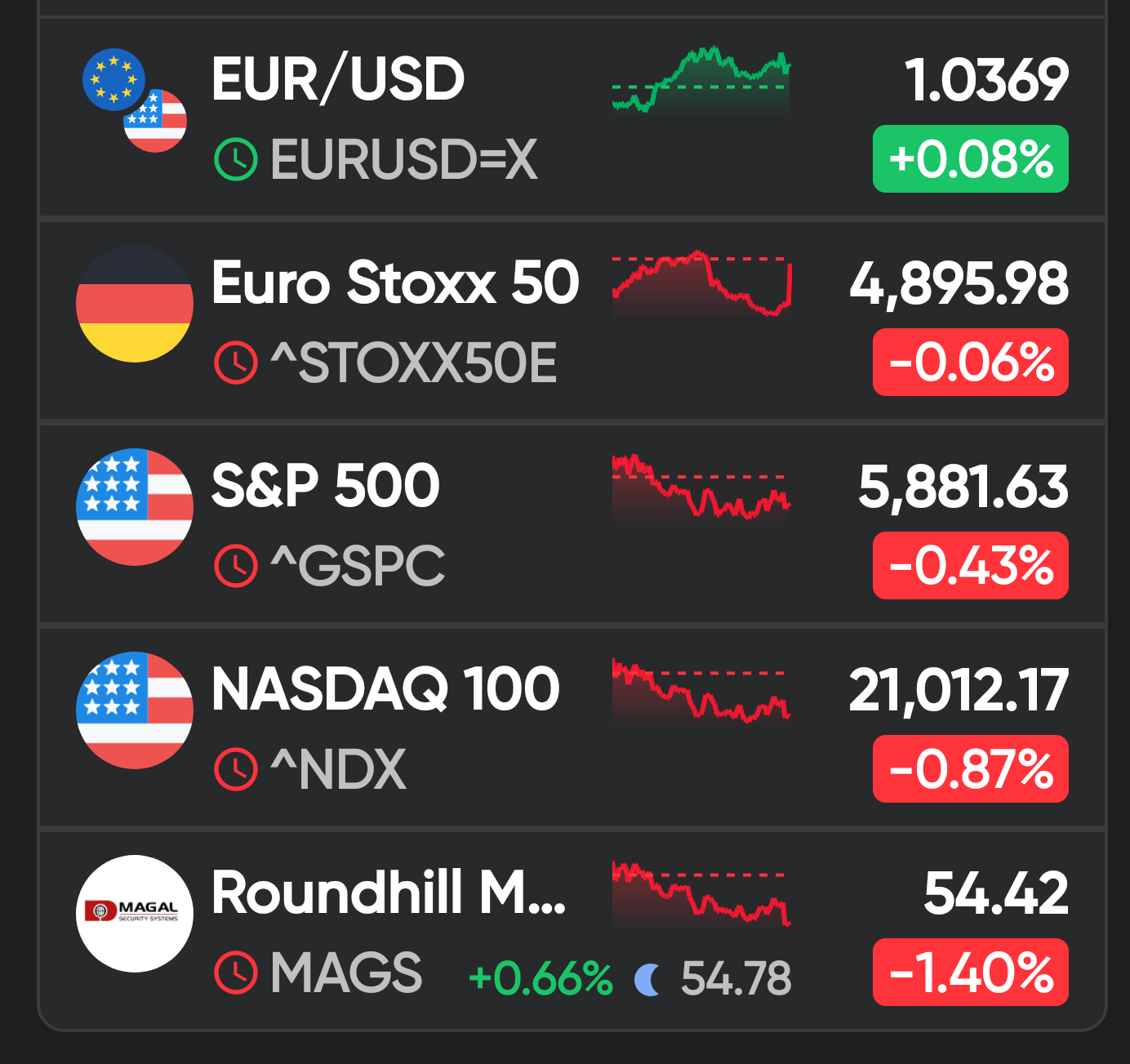

Bond yields are high, which is a concern for stock valuations. The Fed's hawkish stance and the uncertainty surrounding the ECB are contributing to a strong USD (1.036/€).

Today's key economic data point is the American Weekly Unemployment at 14:30h. However, it's unlikely to offer much guidance. Tomorrow's American ISM Manufacturing report could also be inconclusive.

Overall, the market is still testing the waters for 2025. It's likely to rebound somewhat today, but a clearer direction will emerge next week. We recommend closely monitoring bond yields, as they could potentially hinder stock market growth.

Comments

Post a Comment